Ours Products

Products

Having been in operation for over 7 years, we are uniquely qualified to provide expert opinion on the best insurance companies and products available in this market.

GENERAL INSURANCE

Domestic Package (DP) Insurance

This policy insures the home. It combines coverage for the home that is, the building and household contents as well as domestic workers against death or injury while in the course of employment. The policy also covers the homeowners or occupiers against lawsuits for injury or property damage caused to other people (third parties).

Personal Accident and Group Accident Insurance

A Personal accident insurance provides financial benefits to an individual if he/she is involved in an accident resulting in injuries or death. While, Group personal accident insurance provides financial benefits to a group of people such as a family, employees, chamas, learning institutions, SMEs or any other group of people with common interest.

Medical Insurance and Group Medical insurance

Medical insurance policy, also referred to as health insurance, covers the medical expenses incurred by the insured or their dependents. It covers numerous illness and or bodily injuries. It can be taken by an individual or a group of people. The policy can be out-patient (walk in and out of hospital) only or in-patient (admission) only. It can also have a combination of both in and out patient.

Professional Indemnity Insurance

This insurance policy covers liability to a third party arising from the performance of, or failure to perform services by a professional. Insurance is provided in accordance with the limits, conditions and activities defined in the policy.

Fire and Perils Insurance

The basic fire and perils insurance covers loss or damage to property caused by fire, lighting or explosion. The cover can also be extended to cover riots, strike, malicious damage, storm, earthquake, impact by vehicles, aircraft or other aerial devices, subterranean fire, spontaneous combustion or overflowing water from tanks and pipes. This insurance covers assets such as buildings, plant and machinery, stock insurance, office equipment, furniture, fixtures and fittings. The insurer guarantees to pay for the loss or damage to the property for the specified period (usually one year). The valuation of property is made according to the market value.

Business Interruption Insurance

This policy provides cover for loss of profits caused by reduction or interruption of production due to damage caused by fire and allied perils to the insured’s premises. Allied perils are perils such as earthquake, flood, explosion, malicious damage that are insured in

addition to fire at additional premium.

Burglary or Theft Insurance

Burglary or theft insurance covers loss or damage of insured property because of theft accompanied by visible, forcible and violent entry into, or exit out of the insured premises.

The policy extends to cover damage to the doors, windows, walls and roof by intruders in their attempt to gain entry and exit.fixtures and fittings. The insurer guarantees to pay for the loss or damage to the property for the specified period (usually one year). The valuation of property is made according to the market value.

Money Insurance

All businesses handle money in some form – cash, cheques, credit card slips, bankers’ drafts and others- making this form of insurance essential for businesses large and small. Money insurance covers loss or damage of cash in transit, cash in premises, cash in safe, cash with authorised staff and damage to safe/strong rooms. addition to fire at additional premium.

Fidelity Guarantee Insurance

Fidelity Guarantee insurance covers an employer against loss of money, business equipment, securities or other goods belonging to the business resulting from an act of fraud or dishonesty by employees for improper personal financial gain in the course of their duties.The policy extends to cover damage to the doors, windows, walls and roof by intruders in their attempt to gain entry and exit.fixtures and fittings. The insurer guarantees to pay for the loss or damage to the property for the specified period (usually one year). The valuation of property is made according to the market value.

Carriers Legal Liability Insurance

Carriers Legal Liability Insurance insures a carrier (person or entity providing transportation for hire) against legal liability claims. The insurance covers accidental loss or damage to goods in the custody or control of the insured whilst in transit by road, rail, inland waterway, air or any other specified means. The cover territory is within Kenya however, it can extend to East Africa based on agreement with the insurer.

Goods in Transit (GIT) Insurance

Goods in Transit Insurance covers loss or damage to goods and/or merchandise while moving it from one place to another. This cover is restricted to Kenya but can be extended to cover East Africa subject to agreement with the insurance company.

Work Injury Benefits Act (WIBA) Insurance

The Work Injuries Benefits Act No. 13 of 2007, requires that all employers must provide compensation to employees for work related injuries or diseases contracted as a result of work. WIBA insurance policy responds to the requirements of the above Act. It covers employees whilst on duty against accidental bodily injury, disablement or death. Compensation is payable in accordance with the provisions of the WIBA Act 2007. The maximum benefit is set at 96 months’ salary.

Employers’ Liability (EL) Insurance

Employers’ liability insurance protects employers from their legal liability to an employee for injury arising out of, and in the course of employment. The policy protects the Employers against lawsuits brought against them by employees due to allegations of injuries or contracting diseases because of employer negligence. The employee must prove negligence on the part of the employer e.g. if injury is a result of lack of a helmet – which the employer

failed to provide.

Travel Insurance Travel Insurance covers specific events.

The insurance is dependent on coverage limits, which also determine the premium paid. Covered risks and exclusions vary significantly by policy type, insurer, and travel preferences.

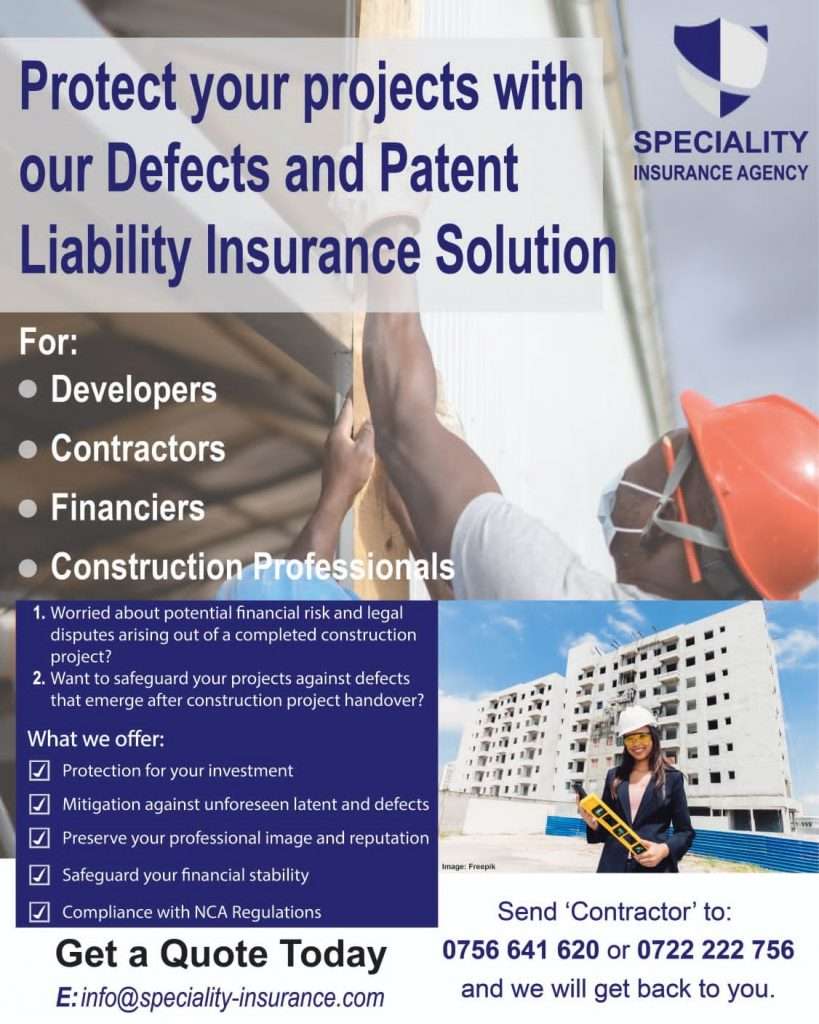

Contractors` All Risks (C.A.R) Insurance

What is C.A.R ?

It is a Policy Cover meant for Contractors undertaking Building and Civil Engineering Works covering risks

surrounding the construction process of an actual property being built or developed at a specified Contract Site. It is

a Term Policy, not an annual Policy i.e. based on the Contract Period which can range from one month to a mega risk of four years equivalent of (48) months. failed to provide.

Marine Insurance

Marine insurance is broadly divided into three categories namely: Marine Hull Insurance, Marine Cargo Insurance and Marine Third Party Liability.

a) Marine Hull insures risks associated with boats, canoes, dhows, vessels, ships and other marine vessels.

Performance Bonds

A Performance Bond is a documented legal undertaking by an insurer given to the Principal in a contract guaranteeing the due performance of the contract by the second party to the contract (our Insured).

Performance Bonds are not insurance risks in the real sense of the word and description of an insurable risk as these dwell more on the integrity of the party being guaranteed(our Insured) as opposed to a risk capable of

scientific and financial evaluation.

Tender / Bid Bonds

These are similar to Performance Bonds only that they are in different use/purpose. They are only used by Bidding Contractors when tendering for Projects.

Motor Insurance Product

Motor private comprehensive insurance covers accidental damage and/or loss to the insured’s private vehicle caused by unforeseen incidences such as collision, fire, theft and other unforeseen natural causes, and also provides compensation to third party injury and third party property.

Motor commercial insurance covers accidental damage to vehicles used for business purposes. It also covers third party injuries and property damage. Such vehicles include lorries and canters.

LIFE INSURANCE

Personal insurance

Term Assurance

This policy offers protection only for a particular period which is agreed upon by the insurance company and insured. It is the simplest and cheapest form of life insurance since it provides life cover only with no investment benefits. The insurance company will pay out the full sum assured if the insured passes away within the insurance period. There are no benefits that are payable if the insured is still alive when the policy matures

Endowment

An endowment policy combines both protection and investment. The insurance company will pay out the full sum assured if the insured passes away within the insurance period. If the insured is still alive when the policy matures, the insurance company will pay out the sum assured and all the bonuses earned in the course of the policy

Whole Life

A whole life policy offers life-long protection to the insured. The insured selects how they would like to pay premiums. It could be throughout your life, you can chose to cease payment at a particular age (for example at 60), or you can chose to pay one single premium

Unit Linked / Investment insurance policies

Unit linked policies also combine protection and investment. A part of the premium is used to purchase life protection and the rest is used to purchase units in an investment fund managed by the insurance company. Investment returns on the policy are linked to the investment performance of the managed fund. e) Funeral Insurance cover Funeral Insurance cover is meant to cater for funeral expenses of a insured or their loved ones in the event of their demise. The benefits are payable within 48 hours after notification of death

Group life insurance

This is a life insurance cover that any group can undertake. It is a key benefit that employers offer employees. The policy document is in the name of the employer who usually pays the premium. As with other types of group benefits, group life insurance is generally cheaper compared to individual policies. SACCOs, Chamas and investments groups also take group life insurance and members pay the premium

PENSION

Pension is a regular payment that is made during a person’s retirement from an investment fund to which that person or their employer has contributed during their working life. A pension or retirement benefit scheme is a form of insurance. The scheme protects members against the risk of poverty in old age by ensuring that they are able to provide for themselves in retirement.

What are the benefits of joining a pension scheme?

– The contributions have a 100% capital guarantee. Retirement benefits schemes managed by insurance companies guarantee that your funds will not be lost. They also guarantee a minimum rate of return.

– Contributions are flexible depending on your financial ability and needs.

– Contributions are easy to make through deductions from your salary, direct debits, mobile money etc

– The fund earns compound interest. This allows contributions to grow into significant retirement savings over time

– It gives one the discipline to save and improve financial security in his/her retirement

– It offers a pooling advantage. Funds from various members are pooled together to form a huge fund that allows a larger scale of investments resulting in higher returns.

– Allows one to create a fund which 60% may be used as additional security for a mortgage in line with RBA Regulations.

– The accumulated fund plus investment income are paid to beneficiaries upon the death of the insured, providing a financial cushion for them

– Withdrawal terms are flexible

– An employer can contribute on behalf of the employee as long as the combined contributions do not exceed 30% of the employees’ salary.

– Provides various flexible payments to a member at retirement i.e. lump sum, pension/annuity and even the option to keep the savings invested and draw an income from it. Tax Benefits and calculations

– Contributions are tax deductible. The Income Tax Act allows for a maximum tax deductible contribution of Ksh20,000 per member per month (or 30% of the salary, or whichever is less)

– Income earned from investments is tax-free and therefore generates more funds for reinvestment.

– On retirement before 65 years, the annual tax-free pension is Ksh300,000. Pension and lump sum payments after the age of 65 are tax-free.

– At retirement or withdrawal, you are entitled to receive tax free lump sum